With post-pandemic B2B trade increasing, sanctions on collecting debt removed, and creditors being less tolerant of late-paying debtors, what impact is this having on credit insurance policyholders placing debt with STA International?

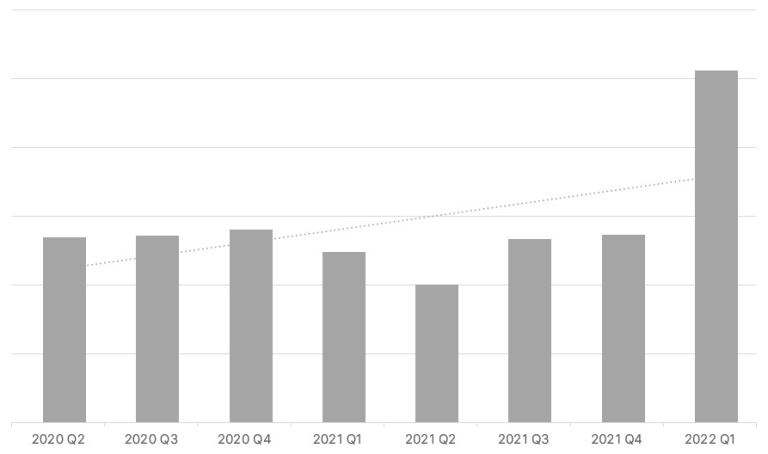

Q1 2022 saw placement increase by 75% over the quarterly average since April 2020, with 80% of the debt volumes coming from policyholders in the Building/ Construction, Food & Drink, and Wholesale/ Manufacturing sectors. Measuring Q1 2022 against the pre-pandemic volumes of 2019, we found a small 10% deficit, a deficit that will disappear should current volumes continue to rise.

Underwriters require policyholders to refer and report debts early to stop a protracted default debt from becoming a claim. Given this policy requirement, tangible benefits must be visible to the policyholder, satisfied with collection success rates and recovery of collection costs and interest from the debtor, each higher than pre-pandemic rates.

For example, in Q1 2022, we recovered 30% more in collection costs and interest than we charged in commission, overall providing a service that returned more money to policyholders than it cost them.