Student debt recovery - how we work

We have dedicated student debt collection and customer service teams from 0800 to 2000, Monday through Friday. For twenty years, we have collected tuition, accommodation, library, research and commercial debts; today, partnering with over 150 universities, colleges and independent student accommodation providers. Last year, we collected c£20m of student debts and today, we have c46k open student debts worth >£174m that we are pursuing.

More recently, staff shortages and recruitment problems have seen demand for help with commercial ledger debts and support for credit control teams with their receivables grow significantly. Separately, our student contact centre can support volume projects such as new student satisfaction surveys and extend your working hours by contacting students, for any reason, in the evenings.

With STA’s Student Debt Collection services, you get much more besides. We aim to provide a holistic approach to solving the challenges facing university income and finance executives.

Student engagement

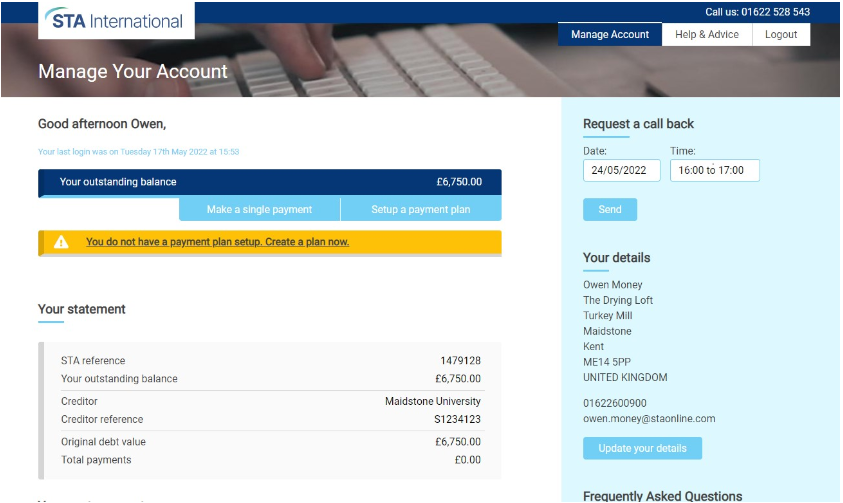

This self-service portal allows the student to view their account, make a one-off payment, complete a financial review, set up a payment plan, check their balance, request a call, webchat, and make changes to contact details. The portal also has a virtual agent that can answer questions. The hub benefits international students needing to pay by instalments to set up a continuous payment authority using a foreign bank account.

Consumer Duty & Treating Customers Fairly

We never harass customers, with controlled dialling and digital or written communication from outbound contact, with clear and regular instructions given to those that want to contact us. Should complaints arise, monitoring and assessment measures enable us to revise our approach by introducing preventative and corrective actions.

Full transparency

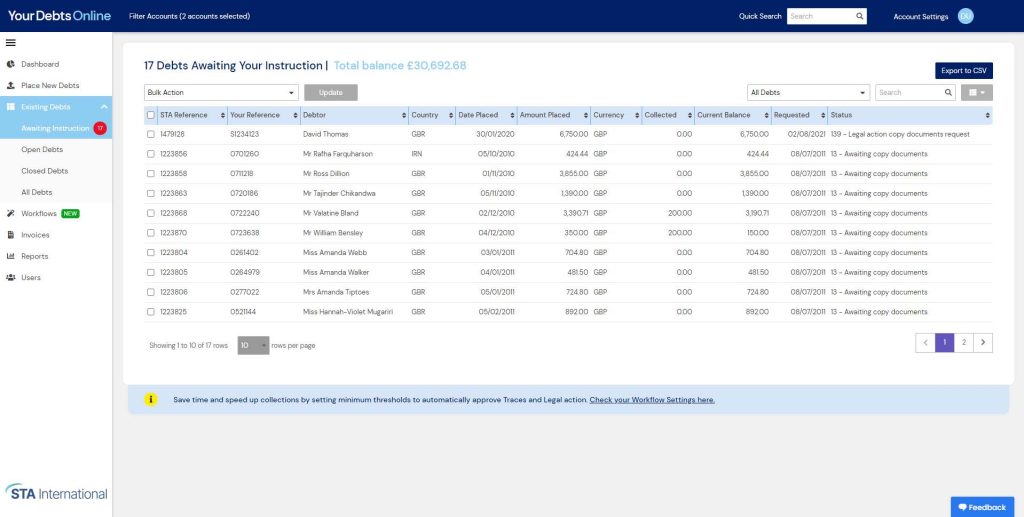

YDO gives you a clear view of what we are doing with the accounts you place with us for collection. Secure password-protected, you can see our overall collection success, the status of every debt, including agent notes, your invoices and statements, and the charges on each account.

Tracing

Former students may never return to the address given to the university and provided to us. When a returned letter is marked ‘gone away’ or an ‘informer’ tells us that the subject is no longer resident at the address provided, we transfer the debt to our specialist in-house trace team following client permission.

Information on the subject is taken from credit reference agencies and consented and public information databases. One of our trace analysts collates the data, looking at the various data-sets, including telephone directory, electoral roll, insurance information, loan applications, credit activity, and residency scores, to determine the subject’s most recent address. Two separate data sets must confirm the address and comply with the Credit Services Association’s Code of Practice.

The trace analyst will attempt to confirm the address via a telephone call wherever possible or send a soft letter to the new address. We must make all calls at reasonable times and intervals, with outbound calls ceasing at 8pm prompt. Investigators will always be circumspect and discreet when attempting their contact and will not bring excessive pressure to bear on the subject.

This independent verification determines ‘positive’ and ‘negative’ traces, ‘positives’ being c90% of all traces, from which we collect c50% of the debt value.

Legal debt collection

The final part of our amicable collection involves the Pre-Action Protocol (PAP). PAP encourages early engagement to enable the parties to resolve matters without the need for court action. We only recommend sending a Letter of Claim (LOC) when all amicable efforts fail, and you should only accept our recommendation if you intend to take legal action for continued non-payment. We send the LOC with full details of the debt, an information sheet, reply form, and standard financial statement, and the customer has 30 days to respond.

With your prior approval, litigation starts when our partner solicitors firm STA Legal issues a Claim via the County Court Bulk Centre (CCBC) in Northampton. CCBC is cheaper, faster, and more straightforward than other County Courts. When you sanction action, we advance UK legal costs and invoice you to save valuable time. Your customer has 14 days to pay or respond before we make an Application for Entering a Judgment. A County Court Judgment (CCJ) is a Court Order that confirms that the debtor has defaulted on payment. The CCJ is the Court’s final decision, which gives you the power to take enforcement action to collect the debt. Recorded against the student’s credit record, the CCJ affects their ability to obtain credit.

At this stage, a range of enforcement actions enables us to recover your debt, including High Court Enforcement, Attachment of Earnings, Garnishee Order, Charging Order, Information Order, and Bankruptcy. By far, our most successful is the use of High Court Enforcement Officers who visit the customer and make payment arrangements or claim goods for resale. The Judgment’s shelf-life is six years giving you time to wait for enforcement when your customer seeks credit or enjoys higher income.

Most of the associated legal costs and fees are recoverable from the student, along with the Court’s mandated rates of interest.